Private Markets

Intelligence

Comprehensive data and analytics to help you raise capital, research managers, and benchmark performance.

Data

Operate with clarity

Complete data on investors, fund managers, and funds across asset classes.

Pine Capital Partners

$10-$50M EBITDA

Consumer, Healthcare, Industrials, Business Services

Address

123 Pine Street, Suite 400

New York, NY 10001

United States

AUM Breakdown

Dry powder plus unrealized value

- Buyout$4.5 (45%)

- Growth$3.5 (35%)

- Private Credit$2.0 (20%)

Contacts

Intelligent prospecting

Access a global network of alternative assets decision-makers to build connections across the private markets.

Pine Capital Partners

| NAME | POSITION | LOCATION | ||

|---|---|---|---|---|

| John Ryan | Managing Partner | New York, USA | J.Ryan@Pinecp.com | |

| Sarah Jay | Principal | New York, USA | S.Jay@Pinecp.com | |

| Michael Chen | Director, Investor Relations | New York, USA | M.Chen@Pinecp.com |

Track Record

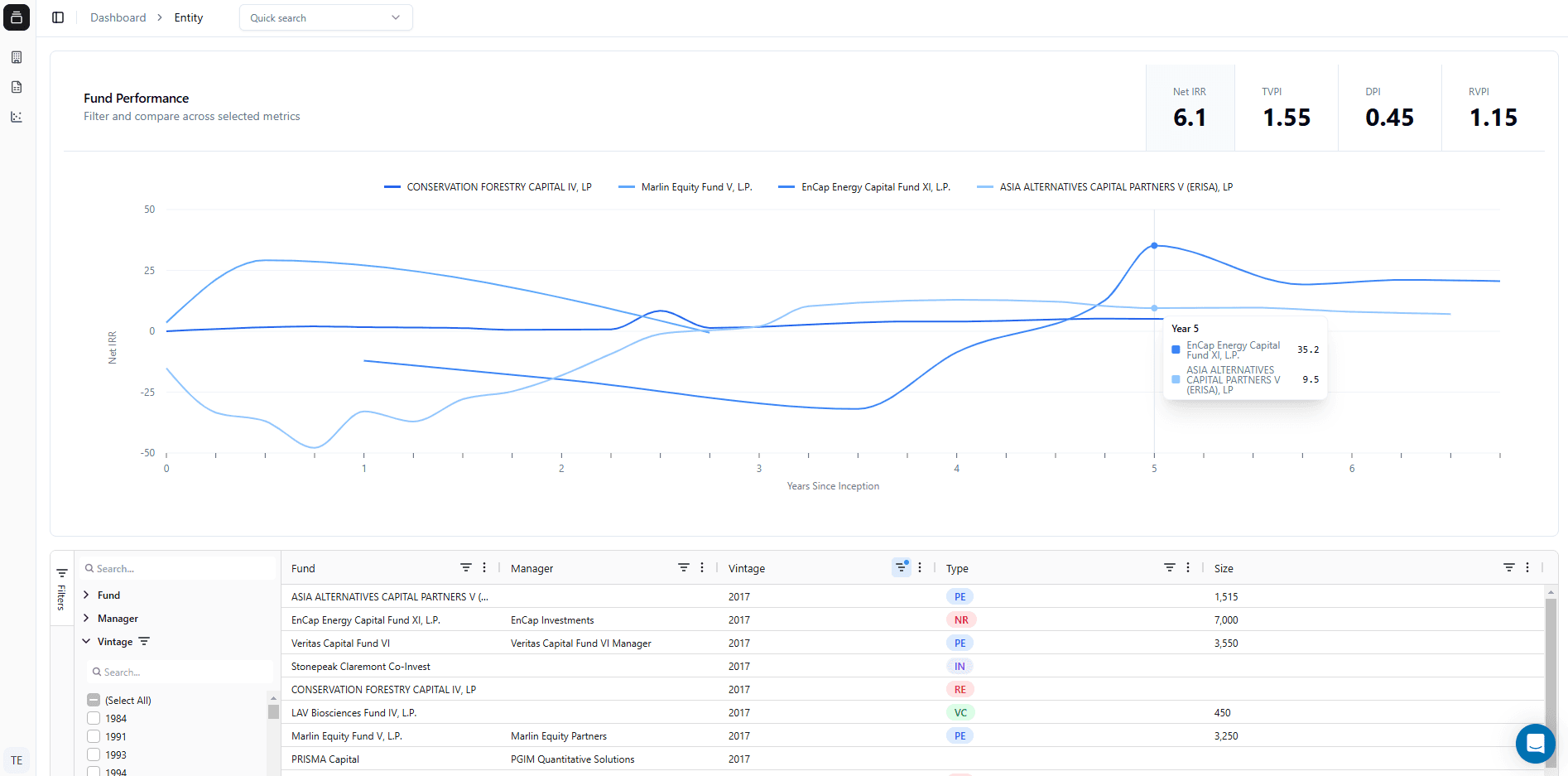

Performance analysis

Compare fund performance against custom benchmarks and track fund managers against the broader market.

Benchmarks

Select a Benchmark

32 Constituent Funds

| FUND | VINTAGE | IRR | TVPI | DPI | |

|---|---|---|---|---|---|

| Spruce Fund X, L.P. | 2019 | 20.5 | 1.92 | 1.15 | |

| Cedar Fund II, L.P. | 2019 | 18.2 | 1.75 | 1.05 |

Bring Clarity to Private Capital Decision-Making

Comprehensive data on investors, fund managers, and funds across all alternative asset classes.

Comprehensive Data

Intelligent Prospecting

Comparative Performance

Fund Benchmarking

Pricing

Start immediately or learn more about enterprise offerings

A simple seat-based subscription model with unlimited usage across all data sets.

$89

/ month per seatComplete Data Access

Full access across all modules and data sets

Contact Intelligence

Up-to-date fund manager details and networking

Advanced Analytics

Customizable benchmarking and performance comparisons

Custom

API Access

Data via API and custom feeds for your systems

Advanced Automations

Unstructured data extraction and fund document processing

Enterprise Security

Integrate with Okta or any OIDC SSO provider

All plans include access to our support team and regular data updates. Enterprise customers receive priority support and customized onboarding.